Expert Advice for Home Buyers Since 2006

Are you planning to buy a home in the U.S. during 2024? Do you have questions about the real estate market or what it takes to succeed? You've come to the right place!

The Home Buying Institute (HBI) is America's leading source for home-buying information and news. We have been educating buyers in the U.S. for 17 years, and it's a mission we take seriously.

Home Buying Guidance for 2024

Our website offers hundreds of articles relating to the home-buying process, mortgage loans, real estate market trends and more. We publish new information every week, to help you stay informed. We are a trusted source for unbiased and factual home-buying advice.

You can use the main menu above to learn about current real estate market conditions in the US, home price trends, mortgage rate forecasts and more.

The "Articles" link will take you to the HBI learning library, where you can learn about every aspect of the home buying process in 2024. Our library contains dozens of in-depth articles and tutorials, with new ones being added every month.

Our Story: Helping First-Time Buyers Since 2006

We have been publishing home-buying tips, tutorials and news since 2006. The Home Buying Institute began as an email newsletter service in the early 2000s, before launching this website in 2006. That's more than 17 years of trustworthy advice and guidance for buyers.

Today, HBI is one of the most frequently visited and widely cited websites catering to home buyers and mortgage shoppers in the U.S.

We have received literally thousands of questions over the years. As a result, we know what questions you might have, as a first-time home buyer. Our website is designed to answer those questions in a clear and helpful manner.

Real Estate Marketing Support

HBI's primary mission is to educate home buyers nationwide and to foster financial literacy. But we also help real estate professionals improve their marketing efforts, with a variety of content-based promotional strategies.

We've pioneered an "education-based marketing" approach for real estate agents and brokers. In short, we help our readers and clients create and promote high-quality content that educates their audience while increasing their exposure at the same time.

Here are some new and popular tutorials:

Real Estate WordPress Guide

The WordPress content management system (CMS) enables real estate professionals to take control of their websites and publishing strategy. This comprehensive guide explains how you can use WordPress to build an effective real estate website.

How to Write Real Estate Blog Posts

The internet is a crowded place. If you want your blog content to stand out and attract readers, you have to go above and beyond to create superior content. Written by a 17-year veteran of real estate blogging, this guide walks you through the research and writing process.

The Best Blog Topics for 2024

Do you publish a blog to educate home buyers in your local area? Need help coming up with some fresh topics? Check out our list of suggested blog topics for 2024, based on current market trends.

How to Host a Home Buying Seminar

First-time home buyer seminars offer a win-win situation. Attendees learn about local market conditions and how to buy a home, while the hosting agent gets to connect with potential clients.

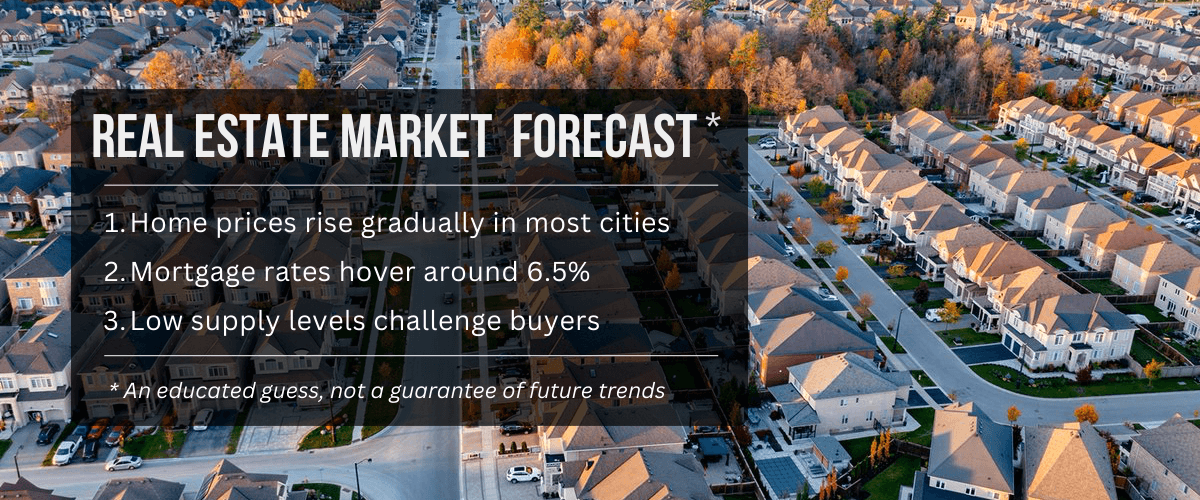

Disclaimers: When reporting on U.S. housing market trends, we often cite third-party forecasts, predictions, etc. Such forecasts are the equivalent of an educated guess and should be treated as such. No one can predict the future of the housing market with total accuracy. HBI makes no claims or assertions about future real estate conditions.