Types of ARM Loan Rate Caps: Initial, Subsequent and Lifetime

Read our most important home buying updates for 2024:

Are you thinking about using an adjustable-rate mortgage (ARM) loan to buy a home? If so, you need to understand the different types of rate caps that can be assigned to these mortgage products.

As their names suggest, ARM loan rate caps can limit how much your interest rises over time. And that's obviously something you want to know about in advance, before signing on the dotted line.

So let's talk about the different types of adjustable-rate mortgage caps, and how they might affect you as a borrower.

Three Types of Adjustable-Rate Mortgage Caps

For most ARM loans, there are three different types of rate caps that might be used. As a borrower, it's crucial that you understand what they are and how they work. They can affect the size of your monthly payments, as well as the total amount of interest you pay over time.

1.Initial Adjustment Cap

"Initial" means first, and that's exactly what this ARM loan cap does. It limits how much your mortgage interest rate can increase the first time that it adjusts.

Most adjustable loans start off with a fixed rate for a certain period of time (e.g., one year, three years, five years, etc.). After that "fixed" phase, the rate will begin to adjust periodically -- annually in most cases. So the initial adjustment cap tells you how much it is allowed to rise on the first adjustment.

For example, if the initial cap for an adjustable-rate mortgage is set at 25%, then the new rate (after that first adjustment) cannot be more than 2% higher than the original rate used during the fixed stage of the loan.

This will make more sense with a realistic example.

Real-world scenario: John and Jane take out a 5/1 ARM loan to finance their home purchase. Their loan has a fixed rate of interest for the first five years, after which it will adjust every one year (or annually). Their initial interest rate for the first five years is 3.95%. Their adjustable mortgage has an initial rate cap of 2%. So in this case, their rate cannot rise any higher than 5.95% during the initial adjustment.

2. Subsequent Adjustment Cap

This is another common type of ARM loan cap that borrowers need to know about. And here again, the name tells you what it is and how it works.

A subsequent (or "periodic") adjustment cap specifies a limit for how much the mortgage interest rate can increase during all of the adjustments that come after the initial change. Mortgage lenders often set the subsequent adjustment cap for ARM loans somewhere around 2%, but that's not necessarily set in stone. It varies.

Real-world scenario: Remember John and Jane from earlier? The interest rate on their 5/1 ARM loan started off at 3.95%. It then rose to 4.95% during the first (or initial) adjustment. Their adjustable mortgage loan has a subsequent rate cap of 2%. So during the next adjustment, it can rise no more than 2%. In this scenario, the couple's mortgage interest rate could rise as high as 6.95% (two percent higher than the previous level of 4.95%) during the second adjustment -- but no higher than that.

3. Lifetime Adjustment Cap

Last, but certainly not least, we have the lifetime adjustment cap on the adjustable-rate mortgage. In some ways, this is the most important of the three types of ARM loan caps. That's because it states how much the borrower's interest rate could rise over the life of the loan.

Lifetime adjustment caps can vary based on the details of the loan, the borrower's credit situation, and other factors. According to the Consumer Financial Protection Bureau, the lifetime cap "is most commonly five percent." But it varies. They can be higher than that.

Review Your 'Loan Estimate' Document

When you apply for a mortgage loan, your lender should provide you with clear information that shows the full cost of the loan. This includes the interest rate, as well as other fees and charges (i.e., closing costs).

They're also required to give you a document known as the Loan Estimate. For an adjustable-rate mortgage, this document will contain important information about the rate caps (though it uses terms like "limits" and "maximum").

Related: What is a Loan Estimate? (consumerfinance.gov)

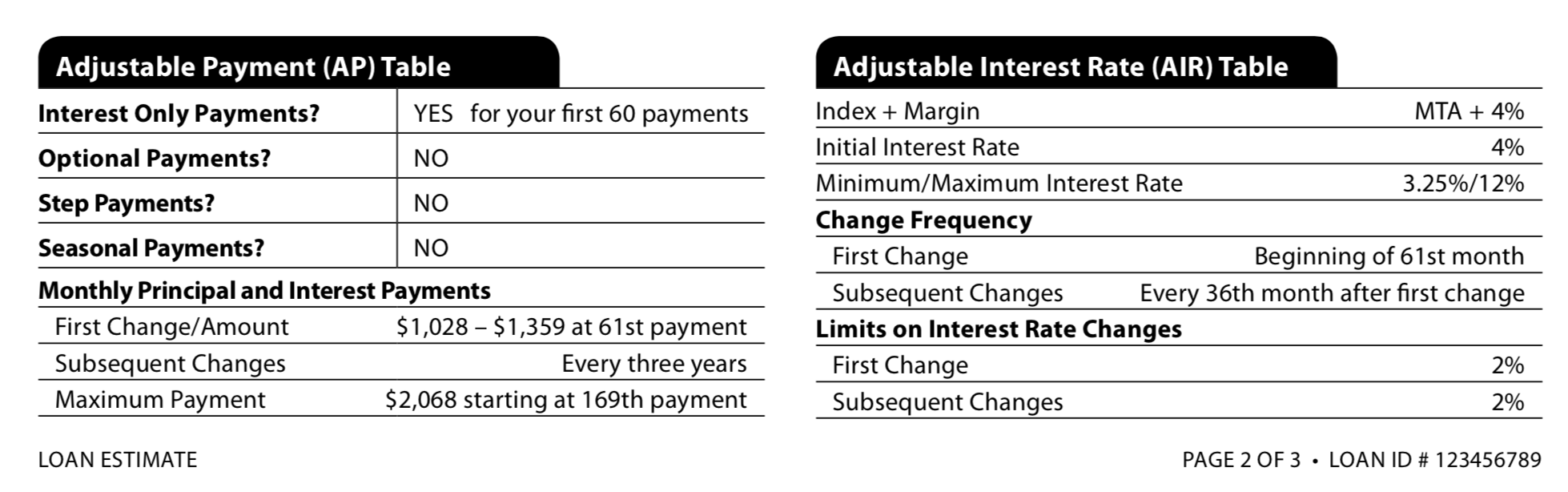

At the bottom of page 2 on this document, we find the pertinent information regarding caps that are in place:

(Image: Snapshot of a Loan Estimate for an adjustable mortgage. Enlarge.)

Here are some things to notice in the image above:

- The right column has a "maximum interest rate" field, which in this example is capped at 12%. That is the lifetime cap. It's the maximum amount the interest rate can rise over the life of this particular loan.

- In the section entitled "Limits on Interest Rate Changes," you can see the initial and subsequent caps that were described earlier.

- For this sample ARM loan, the initial adjustment can increase by no more than 2% from the starting interest rate.

- During subsequent adjustments (after the first one), the rate can go up by no more than 2% from its previous level.

- The sample Loan Estimate above also indicates that this particular adjustable-rate mortgage will remain fixed for the first five years. We know this, because it says the first change will be "Beginning on the 61st month."

- We also know that the rate will adjust every three years, or "Every 36th month after first change." So this is a 5/3 ARM loan. It remains fixed for the first five years of the term, and then adjusts once every three years thereafter. There are other types of adjustable mortgages as well.

To recap: Most ARM loans have three main types of caps assigned to them. There's usually an initial cap that limits how much the interest rate can increase during the first or initial adjustment. There's a subsequent (or periodic) cap that limits any increases that occur after the first adjustment. And there's a lifetime cap that limits how much the rate can increase during the "life" of the loan.