Getting an FHA Loan After Chapter 7 Bankruptcy: The Waiting Period

The FHA loan program is a popular mortgage option for people who have had credit issues in the past, including a pervious bankruptcy filing.

FHA loans tend to be more lenient when it comes to past bankruptcies, foreclosures, and other negative financial events. That's because these loans are backed by the federal government.

This guide addresses two some common questions on this subject: Can I qualify for an FHA loan after a Chapter 7 bankruptcy, and if so how long do I have to wait?

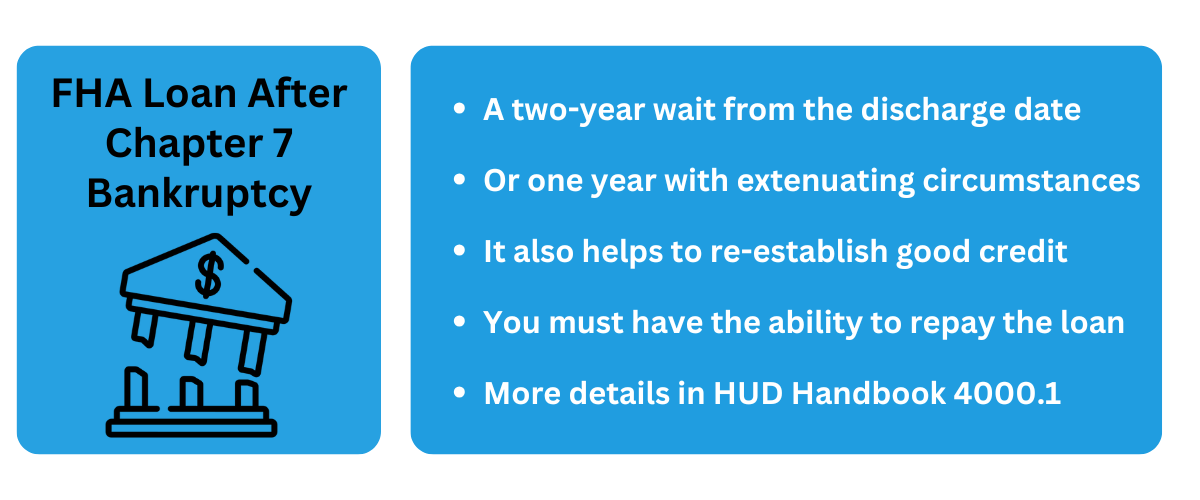

Here are five things you should know right off the bat:

- 1. It's entirely possible to get an FHA loan after a Chapter 7 bankruptcy.

- 2. But the HUD guidelines for this program have some specific requirements.

- 3. Borrowers usually have to wait at least two years from the discharge date.

- 4. The waiting period could be 12 months with extenuating circumstances.

- 5. Borrowers must also re-establish a pattern of responsible credit usage.

The bottom line: Most people who have filed for Chapter 7 bankruptcy in the past have to wait at least one or two years before they can qualify for a new FHA loan.

What Is an FHA Loan?

To understand the rules regarding bankruptcy filings, you must first understand what an FHA loan is and how it differs from a conventional or "regular" mortgage product.

The Federal Housing Administration (FHA) home loan program provides insurance protection to mortgage lenders. If a lender originates on of these loans, and the borrower is unable to repay it, the lender receives insurance compensation from the federal government.

So, while these loans are generated in the private sector, the official requirements come from the federal government, via the FHA and its parent organization HUD.

Chapter 7 Bankruptcy Explained

There are different types of bankruptcy filings used by individuals. Most people either file for Chapter 7 or Chapter 13.

Chapter 7 is the most common option, for a couple of reasons:

1. Simplicity and Speed

Chapter 7 is often called "liquidation" or "straight bankruptcy." It involves selling non-exempt assets to pay off creditors. This process is generally faster, often taking only a few months.

2. Debt Discharge

Chapter 7 allows for the discharge of many unsecured debts, such as credit card debt, medical bills, and personal loans. In this context, "discharge" means that the debts are legally forgiven and no longer have to be paid.

Two-Year Waiting Period After a Chapter 7

The rules for FHA loans come from the Department of Housing and Urban Development (HUD), which oversees the Federal Housing Administration.

As you might imagine, HUD has specific rules for people who are seeking an FHA loan after a Chapter 7 bankruptcy filing. And that includes a minimum waiting period.

Here's what HUD Handbook 4000.1 says on the subject:

"A Chapter 7 bankruptcy (liquidation) does not disqualify a Borrower from obtaining an FHA-insured Mortgage if, at the time of case number assignment, at least two years have elapsed since the date of the bankruptcy discharge. During the most recent two years, the Borrower must have: reestablished good credit; or chosen not to incur new credit obligations."

And here's what it says about extenuating circumstances:

"An elapsed period of less than two years, but not less than 12 months, may be

acceptable, if the Borrower: can show that the bankruptcy was caused by extenuating circumstances beyond the Borrower’s control; and has since exhibited a documented ability to manage their financial affairs in a responsible manner."

There's a lot to unpack here, so let's break it down:

- Waiting Period: You generally need to wait two years after your Chapter 7 bankruptcy was discharged, before applying for an FHA loan.

- Start Date: The two-year clock starts from the date of your bankruptcy discharge, not from the date you filed.

- In the Meantime: During those two years, you need to either rebuild good credit or show that you haven't taken on any new debts.

- Extenuating Circumstances: The waiting period could be shortened to 12 months if there were circumstances beyond your control, like a job loss or serious illness.

- Financial Responsibility: Even with extenuating circumstances, you'll need to prove that you have managed your finances responsibly since the bankruptcy.

Note: The above rules apply to Chapter 7 filings, specifically. If you've filed for Chapter 13 (a.k.a., "wage earner's plan"), you'll encounter different rules not covered in this guide.

Stricter Rules for Conventional Loans

Conventional home loans generally have a longer waiting period for borrowers who have had a Chapter 7 bankruptcy filing recently. Conventional financing is stricter in other areas as well, including credit scores.

Definition: A "conventional" mortgage loan is one that is not insured by the federal government. The conventional label is used to distinguish these "regular" home loans from government-backed mortgages like FHA.

If you want to qualify for a conventional mortgage loan after a Chapter 7 bankruptcy filing, you will probably have to wait at least four years.

However, if you can document some extenuating circumstances that were beyond your control, you might be able to shorten the waiting period to just two years.

Here's what it says on the Fannie Mae website, regarding conventional mortgages:

"A four-year waiting period is required, measured from the discharge or dismissal date of the bankruptcy action."

However, as with FHA loans, there's a shorter wait for extenuating circumstances. Fannie Mae's guidelines go on to explain:

"A two-year waiting period is permitted if extenuating circumstances can be documented, and is measured from the discharge or dismissal date of the bankruptcy action."

What are Extenuating Circumstances?

We've talked a lot about extenuating circumstances, and how they can shorten the waiting period after a Chapter 7 bankruptcy.

This is true for both FHA and conventional mortgage loans:

- FHA: Having extenuating circumstances could shorten the waiting period from the standard two years to as little as 12 months.

- Conventional: Extenuating circumstances could reduce the wait time from four year to two years.

But what is an extenuating circumstance in this context?

Definition: Extenuating circumstances are unavoidable events or situations beyond a person's control that result in significant reduction of income or financial hardship.

Surprisingly, the FHA does not provide a list of specific events or scenarios that meet this definition. Instead, they generally leave it up to the mortgage lender to decide.

Here are some scenarios that could be considered extenuating:

- Significant medical expenses not covered by insurance

- Prolonged illness or disability limiting the ability to work

- Loss of income due to the death or illness of primary provider

- Involuntary job loss resulting in long-term unemployment

- Reduction in income due to company downsizing or business failure

- Other adverse events that were beyond the borrower's direct control

Note: This list is not exhaustive. If you were affected by what you believe to be an extenuating circumstance that contributed to your bankruptcy, let your lender know.

The FHA also requires mortgage lenders to verify that extenuating circumstances actually did exist. This is typically done through the use of certain documents, such as a job layoff notice, financial records showing a loss of income, etc.

What You Can Do in the Meantime

To recap, home buyers who want to use an FHA loan after a Chapter 7 bankruptcy typically have to wait at least years after the discharge date.

If the bankruptcy was due to extenuating circumstances beyond the borrower's control, the waiting period might be reduced to just 12 months.

But there are things you can do in the meantime to improve your chances:

1. Paying all of your bills on time.

This is crucial, because your payment history accounts for 35% of your FICO credit score. Restoring your credit could help you get approved for another loan after bankruptcy, and paying your debts on time is the best way to boost your score.

2. Saving money for your upfront expenses.

It might be hard to save money while paying off your old debts, but it's well worth the effort. At a minimum, you will need to have sufficient funds to cover your down payment, your closing costs, and possibly your first few mortgage payments.

Frequently Asked Questions from Borrowers

We've covered a lot of important information here. So let's conclude this guide by answering some key questions borrowers have on this subject.

(Note: Some of these questions have been answered previously. We've included them here to reiterate the key points made throughout this guide.)

1. How long after a Chapter 7 bankruptcy can I apply for an FHA loan?

For a Chapter 7 filing, current FHA guidelines in 2025 generally require a waiting period of two years from the discharge date. During this time, you must reestablish good credit and demonstrate financial stability.

2. Are there exceptions to the 2-year waiting period?

Yes, the FHA may allow exceptions to the 2-year waiting period if you can document that the bankruptcy was caused by circumstances beyond your control. This might include a severe illness or job loss, among other things. But again, you must demonstrate responsible financial behavior since the discharge.

3. How do I explain my extenuating circumstances to the FHA?

The FHA usually requires a written explanation of the circumstances that led to the bankruptcy. This explanation should be honest, clear, and supported by evidence showing the issue was beyond your control and that you have taken steps to prevent a recurrence. Your mortgage broker or loan officer can advise you on this.

4. What credit score do I need to qualify for an FHA loan?

The FHA requires a minimum credit score of 500, but a score of 580 or higher is needed to qualify for the 3.5% down payment option. Lower scores may require a higher down payment or make approval more challenging, especially for those with a recent bankruptcy.

5. Is the waiting period the same for bankruptcy and foreclosure?

No. In the context of FHA loans, both of these events have different (but similar) rules and requirements. According to HUD, a borrower with a foreclosure or a "deed in lieu" of foreclosure must wait three years before applying for an FHA loan. But mortgage lenders may grant an exception to this rule if extenuating circumstances led to the foreclosure.

6. What income documentation will I need to provide?

When applying for an FHA loan following a bankruptcy, you'll probably be asked for: recent pay stubs, W-2s or 1099s for the past two years, and tax returns. Self-employed individuals may need to provide additional documentation, such as profit and loss statements.

7. How can I improve my chances for approval after a Chapter 7?

You can improve your chances by reestablishing good credit, saving for a down payment, maintaining steady employment, and demonstrating responsible financial habits. A strong application package with documented explanations can also help.

Disclaimer: This information is intended for a general audience and does not constitute financial advice. Your situation might differ from the scenarios and examples presented above. If you have questions about this subject, you can refer them to a HUD-approved mortgage lender or use the FHA Resource Center.

References

The following official resources were consulted when creating this guide:

- Fannie Mae Selling Guide, December 2024, Section B3-5.3-07

- HUD Handbook 4000.1, part II-A-5, "Manual Underwriting of the Borrower"