What Happens on Closing Day and the Week Leading Up to It?

For buyers, closing represents the final step of the home buying process. It's when you sign the paperwork needed to complete the transaction, pay the down payment and closing costs, and get the keys to your new house.

But what does it mean to "close" on a home? What happens on closing day, and in the days leading up to it? This guide explains everything you need to know!

What Happens During the Week of Closing

We'll be taking a deep dive into the process below. But first, here's a simple summary of what you can expect during a real estate closing and in the days leading up to it.

- Review the Closing Disclosure: Ensure all loan terms and closing costs are correct, using the disclosure form provided by your lender.

- Conduct a Final Walkthrough: Visit the home shortly before you close to make sure it's in the agreed-upon condition with no new damage.

- Obtain Insurance: Secure a homeowners policy prior to closing in order to meet your lender's requirements and protect your investment.

- Sign Documents: Carefully review and sign all of the documents needed to finalize the mortgage loan and the transfer of the property.

- Prepare Your Costs: Arrange for either a cashier's check or wire transfer to pay for your down payment and finalized closing costs.

- Receive the Keys: Ownership of the property will be legally transferred from the seller to you, and you'll get the keys to your new home.

As you can see, a lot of important events take place during the closing and in the week before. But it mostly centers around finalizing paperwork and distributing funds.

You won't have to manage this all on your own. A title or escrow company will manage it for you, making sure everything gets done.

The Lead-Up: 1 to 2 Weeks Out

There's usually a lot of activity in the days leading up to the final closing, and it's all important. These final details and procedures pave the way for the actual closing process.

Here's what home buyers should expect one to two weeks before closing:

1. Loan Finalization

One or two weeks before you are scheduled to close, your mortgage lender (and underwriter) will finalize your loan for approval and funding.

During this time, the underwriter might request additional information from you, such as an explanation for a certain bank transaction. So keep an eye out for such requests and respond promptly to prevent closing delays.

2. Title Search and Insurance

Before you can take ownership of the home, a title company will research the property's history to ensure there are no outstanding claims or liens on the title (ownership record).

You can also purchase an owner's title insurance policy, if you choose, to protect yourself from any unforeseen title issues that might arise after the closing.

3. Homeowners Insurance

Before your closing, you'll also need to purchase a homeowners insurance policy to protect your home (at a minimum) as well as your personal belongings. Your mortgage lender will want to see proof of insurance coverage prior to finalizing the loan.

The timing for such requirements can vary, so you'll need to ask about it. And don't wait until the last minute. Arranging your coverage ahead of time can help keep the process on track.

4. Final Walk-Through

A few days before closing, you'll have a chance to revisit the home to conduct what's known as the final walk-through. Use this opportunity to make sure the property is in the same condition as when you signed the purchase agreement.

Don't sweat the small stuff. It's common for homeowners to put some new dings and scrapes in the house when moving out, despite their best efforts. But do keep an eye out for any serious issues that weren't there before.

Also check to see if any agreed-upon repairs have been completed, and that all appliances and fixtures included in the sale are present and functional. If you find anything amiss, address it with your real estate agent ASAP.

What to Expect During the Actual Closing

First of all, you should know that "the closing" can actually take place over several days. Or it might happen all in one day, if you have an efficient closing agent and a straightforward transaction.

But don't worry if it takes more than one day. It's a common scenario.

The closing usually takes place at a neutral location, like a title or escrow company's office, or an attorney's office in some cases. The escrow agent (or attorney) will coordinate the process, gathering all of the documents needed to finalize the sale.

These days, a lot of the closing process can be handled digitally, using e-signature platforms like Docusign. This can simplify and streamline the process. But you might still be required to attend an in-person meeting for identity verification and/or the witnessing of signatures.

When all of the closing conditions have been met, the escrow agent will distribute funds as per the purchase agreement. This completes the transaction, as far as the home buyer is concerned.

A lot of money moves around during the closing process. The seller gets paid. The real estate agents receive their commissions. And you'll pay your down payment and closing costs.

Here are some things you might need to do on closing day:

1. Review and sign a lot of documents

You might spend a few hours reviewing and signing important documents related to the sale of the home. These documents are needed to finalize your mortgage loan agreement and officially transfer ownership of the home, among other things.

Don't feel pressured to rush through this. Take your time, ask questions if anything is unclear, and make sure you understand what you're signing.

At closing, home buyers usually sign the following documents:

- Promissory Note: A legal document where you agree to repay the loan, detailing the loan amount, interest rate, and repayment terms.

- Mortgage: A document that secures the loan by using the property as collateral, allowing the lender to foreclose if you default on the loan.

- Deed: A legal document that transfers ownership of the property from the seller to you, the buyer.

- Closing Disclosure: A form that lists all final terms of the loan, including the loan amount, interest rate, monthly payments, and closing costs.

- Escrow Disclosure Statement: A document that outlines the initial escrow payments for property taxes and insurance that will be part of your monthly mortgage payment.

This is a partial list. You might have to sign additional closing documents as well, depending on your situation. Your escrow company will let you know.

2. Pay your down payment and closing costs

You'll also have to pay your down payment and closing costs in order to finalize the transaction.

- The down payment is your initial investment in the property that gives you some skin in the game.

- Closing costs are the various fees and charges that accumulate during the home buying and mortgage process.

Closing costs for home buyers typically include loan origination fees, title search fees, property survey fees, prepaid interest, prepaid property taxes, government recording fees, and real estate transfer taxes.

They can add up to thousands of dollars on average, so prepare for this in advance.

Home buyers usually pay with either a cashier's check or (less commonly) a wire transfer. If you use the wire transfer method, keep an eye out for fraud which is rampant these days.

The escrow agent acts as your guide throughout this process. So don't hesitate to ask them questions if you're not sure about something. It's their job.

Watch Out for This Important Document

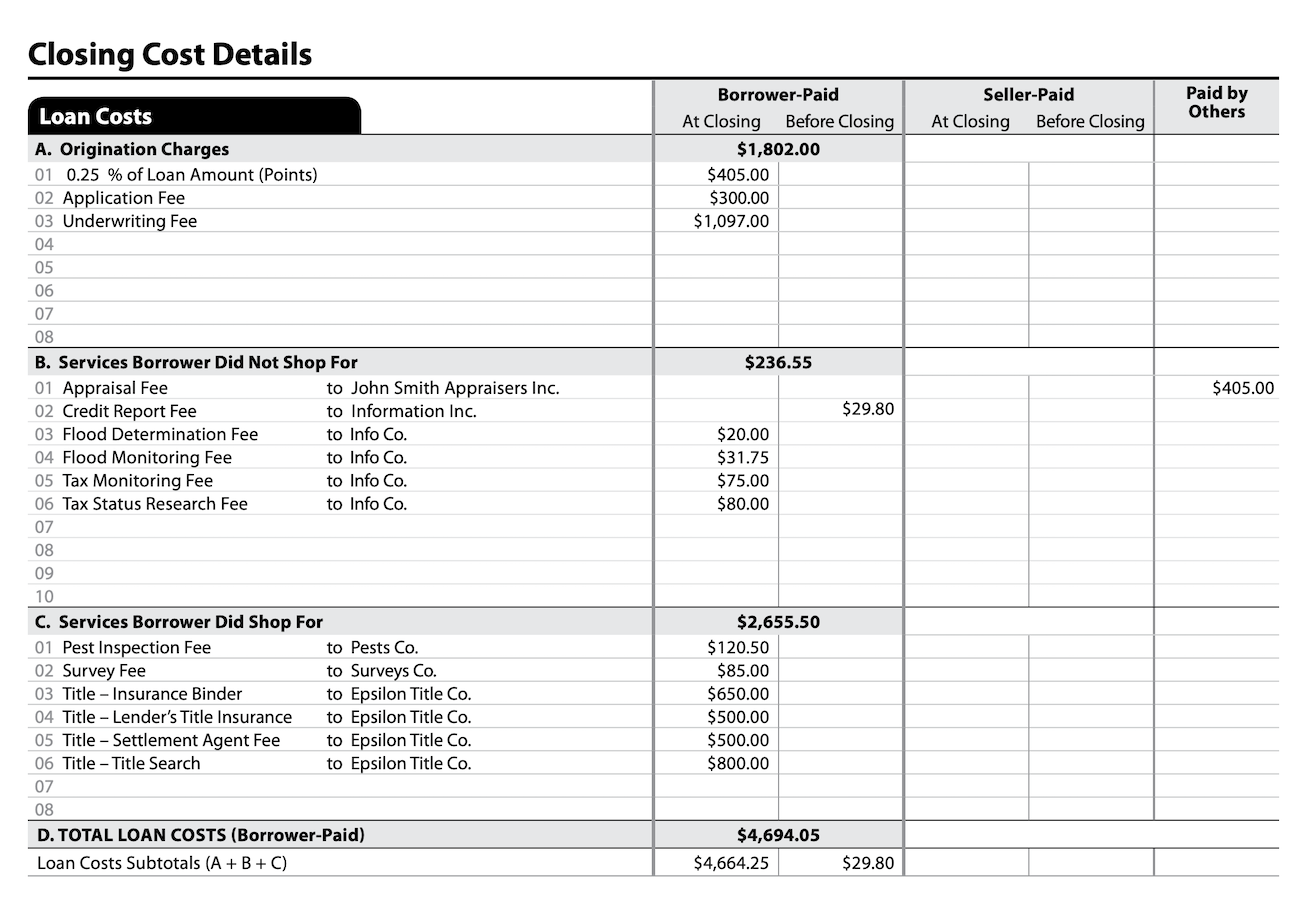

The Closing Disclosure is one of the documents you'll have to sign when you close on the house. It's also one of the most important documents, because it breaks down your closing costs and other key information about your loan.

The Consumer Financial Protection Bureau (CFPB) requires mortgage lenders to provide this disclosure to borrowers at least three business days before the scheduled closing. This gives you time to review the document and ask your lender questions.

The Closing Disclosure also standardizes the format for presenting loan terms and closing costs. It's designed to be easy to understand, even if it's your first time reading one.

The screenshot above shows Page 2 of the Closing Disclosure document, where it offers an itemized list of the home buyer's closing costs. You'll notice that it also provides the total amount due, shown at the bottom. That's the amount the buyer would bring to the closing.

In summary, the closing process involves a lot of paperwork and the final distribution of funds. And at the end of it all, you'll walk away with the keys to your new house.