How to Correct Credit Report Errors (Through Equifax, Experian and TransUnion)

Read our most important home buying updates for 2024:

According to a study published by the Federal Trade Commission (FTC) in 2013, one in four consumers claimed having found errors on their credit reports. The following statistic was even more startling: 5% of U.S. consumers had errors that were serious enough to "lead to them paying more for products such as auto loans and insurance."

In other words, 5% of these folks were being charged higher interest rates on financial products due to someone else's mistakes. Disturbing, but true.

This is why it's so important to check your file for accuracy, especially if you're planning to apply for a loan in the near future. And that brings us to the topic of today's lesson, how to correct credit report errors through Equifax, TransUnion and Experian.

Why Your Credit Reports Matter

Why does your credit report even matter? Well, if you're the kind of person who pays cash for everything, it actually doesn't mean much. If you never use loans or credit cards, you'll probably never undergo a credit check. But there aren't many people in this situation. Most of us rely on third-party financing at some point in our lives, and sometimes repeatedly. This is where your credit report comes into the picture.

When you apply for a mortgage loan, a car loan, or any other type of financing, the lender is going to review your credit score. In truth, this is only one of many things they will review when considering you for a loan. But it's also one of the most important criteria. Your score is derived from the information contained within your credit reports, and those records are a direct reflection of your financial history and habits.

Bottom line: Negative information contained within your reports (late payments, delinquencies, bankruptcies, etc.) can lower your score. This in turn could make it harder for you to get approved for credit cards, auto loans, mortgages, and other types of third-party financing. People with lower scores also tend to pay more in interest, because lenders and creditors consider them to be a higher risk.

How to Correct Errors Through Equifax, TransUnion and Experian

In the U.S., consumer credit reports are maintained by three companies -- Experian, Equifax and TransUnion. They compile data separately and do not share information. As a result, you have three different reports, and three different scores that are based on them. Keep this in mind as you read through the steps below.

So, how do you correct credit report errors, given the fact that they are maintained by three different companies? You must do it individually, disputing mistakes through the company that produced them. Here's how to go about it.

Step 1. Get Copies of Your Current Reports

This is actually the easiest step in the whole process. By federal law, you are entitled to receive a free credit report from the three reporting bureaus (TransUnion, Experian and Equifax), once per calendar year. You can request your reports by visiting the government-regulated website at AnnualCreditReport.com.

Just beware of impostors. There are many official-looking websites that offer "free" credit reports to consumers. But they are usually associated with some kind of monthly monitoring service that is not free. Use the website mentioned above. It is jointly owned and operated by the three reporting companies, and closely monitored by the Federal Trade Commission. If you go anywhere else, you might get roped into some kind of monthly service, which you probably don't need at this point.

Step 2. Review You Reports for Errors

So now you have copies of your three credit reports from Equifax, Experian and TransUnion. What's next? How do you find and correct errors contained within your reports. Basically, you go through them line by line, looking for any information that is inaccurate or outdated.

Inaccurate information might include a misspelled name, an incorrect address, or (even worse) an incorrect Social Security number. Outdated information may include a negative entry that is beyond the expiration date.

Negative information (such as missed payments and other delinquencies) can only remain on your credit report for up to seven years. Bankruptcy information can stay on for up to ten years. Negative entries must be removed from your credit reports, according to their respective expiration dates. If they are not removed at the right time, you can dispute it through the company that produced the erroneous file (Experian, TransUnion or Equifax).

Unfortunately, outdated information is a common occurrence. How do you correct such errors, to have them removed from your credit reports? You file a dispute with the reporting agency, as explained in the next step.

Step 3. Dispute Any Errors That You Find

If you find a mistake on one or more of your reports, you should correct the problem immediately. We have already talked about the reason for this. It could affect your ability to qualify for loans, credit cards and more. It could also lead to higher interest charges.

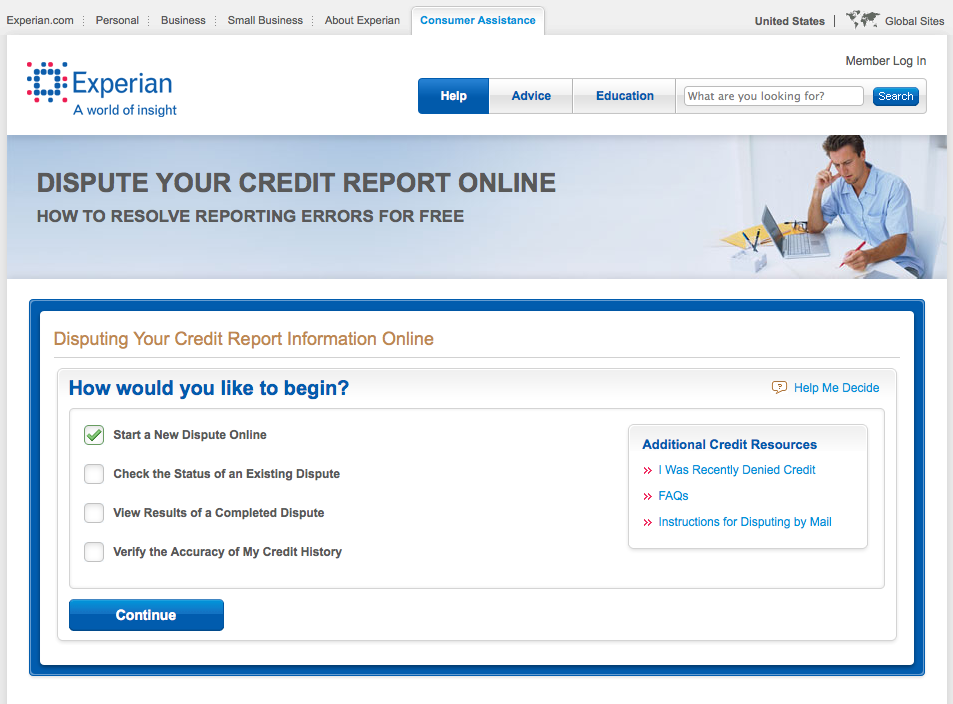

Experian, Equifax and TransUnion all have a "disputes" section of their websites. You can find it from the home page of these companies, and you can initiate the dispute process online. This is typically the first step in correcting errors, though you can handle it by mail if you choose.

Here are the websites, mailing addresses, and phone numbers for the three companies:

- Equifax: 800-685-1111; P.O. Box 740241, Atlanta, GA 30374; www.equifax.com

- Experian: 888-397-3742; PO Box 2002, Allen, TX 75013; www.experian.com

- TransUnion: 800-888-4213; P.O. Box 2000, Chester, PA 19022; www.transunion.com

Here's a snapshot of the dispute page on Experian's website. Click to enlarge.

The benefit of disputing errors online is that you can log back in later to track the progress of your dispute. You may have to send supporting documents by fax or mail. But in most cases, starting the process online may expedite it (and expediency is a plus when you want to correct credit report errors).

If you have hard-copy documents that support your dispute, you should send those to the company as well. This will increase the chance that they remove the item(s) in question.

The law is on your side here. The entire dispute process is regulated by the FTC and standardized by federal law. For instance, according to the Fair Credit Reporting Act (FCRA):

"If the CRA [credit reporting agency] finds during the reinvestigation that a disputed item is inaccurate, incomplete, or cannot be verified, the CRA must delete or modify the item.33 No later than five business days after the completion of a reinvestigation, a CRA must provide written notice to the consumer of the results of the reinvestigation." -FCRA, Section 611(a)(5)(A).

Typically, the CRA that receives the dispute will forward it along to the creditor who supplied the erroneous or outdated information. This might be a bank, lender, or card issuer you've dealt with in the past.

Upon receiving the dispute from the CRA, the company that furnished the data must take the following steps:

- Investigate the disputed information.

- Review all relevant information provided by the CRA.

- Report the results of the investigation to the CRA.

- If the information turns out to be incomplete or inaccurate, they must report this to all nationwide CRAs to which they have supplied the information.

- Complete their investigation within the 30-day period that the CRA has to complete its own reinvestigation.

Step 4. Follow Up Persistently

Steps 1 - 3 explain how to correct credit report errors through Experian, TransUnion, and Equifax. But there is one more component we haven't discussed yet, and that is persistence.

The reporting bureaus don't have much incentive to modify your reports. It takes time and effort on their part, but they really don't get anything out of it. Yes, they are required by law to investigate all disputes, and to make timely corrections were needed. But this doesn't change an important truth about the consumer reporting industry -- you are not their primary customer. So you must stay on top of them until you achieve the desired result.

I recommend keeping a log or journal of all the actions you take to correct your credit report errors, such as documents you have sent, any applicable names and dates, and whatever correspondence you have with the people at the reporting agency. If everything works like it should, you won't really need any of this information because your reports will be corrected in a timely and proper manner. But if your dispute is ignored for any reason, or if it drags on beyond the 30-day window allowed by law, you'll be glad you kept notes along the way.

Reporting Mistakes: an Unfortunate Reality

In a perfect world, you wouldn't need to know how to correct errors on your credit reports, because such mistakes would never happen in the first place. But we don't live in a perfect world, and the truth is these errors are fairly common. The Federal Trade Commission study cited at the start of this article is evidence of this.

So the best thing you can do, as a consumer, is to monitor your reports for erroneous information, and dispute any mistakes you find -- with diligence and determination.