What Is a Mortgage Origination Fee, and 5 Other FAQs

Read our most important home buying updates for 2024:

What is a mortgage origination fee? Why do lenders charge them? How much do they cost on average, and are they tax-deductible?

We receive questions like these on a regular basis. So we have compiled some of the most frequently asked questions on this topic, for your convenience. As always, we will start with a basic definition and proceed from there.

1. What is a mortgage origination fee?

What is a mortgage origination fee? In simple terms, it is the cost of doing business with a lender. It's a fee charged by a broker or lender for originating a home loan. In this context, "origination" is just another word for creation. The lender is charging you a certain amount of money to create -- or originate -- your home loan.

These fees are generally expressed as a percentage of the total amount being borrowed. The bigger the loan, the bigger the fee. They are typically paid up front, as part of the borrower's closing costs (as opposed to being rolled into the loan).

The mortgage origination fee makes up the bulk of the lender's up-front profit. Many of the other closing cost fees you pay at closing will go toward other people besides the lender. For example, title-related fees will be paid to the title company, appraisal costs are paid to the appraiser, etc. The origination fee is how the lender makes money on the front end of the transaction.

2. How much do these fees cost on average?

On average, home buyers pay 1% of the loan amount in the form of an origination fee. For example, on a loan of $300,000, a 1% origination fee would come out to $3,000. So the more money you borrow, the higher the fee.

If your lender is charging you a mortgage origination fee much higher than 1%, you should ask them why. This would be considered an above-average cost in today's market, and would therefore require some investigation on your part.

You should also keep an eye out for something called the mortgage broker fee. This is money paid to the broker who acts as a middleman between the borrower and the lender. You should only be charged one or the other -- but not both. So if you receive a Good Faith Estimate form (explained below) that shows both a mortgage origination and a broker's fee, you should ask some questions. In most scenarios, you would only pay one or the other.

3. Are mortgage origination fees negotiable?

Yes, origination charges can generally be negotiated downward. But the lender will probably raise the interest rate if they lower their origination fee, to compensate for the lost revenue on the front end. Pay now, or pay later.

So you have to ask yourself two questions:

- Which strategy is going to save me money over the long term?

- What are my priorities regarding upfront costs and long-term costs?

If you're more concerned with minimizing your monthly payments, you might want to pay higher fees and/or points up front to get a lower interest rate. On the contrary, if you would rather reduce your up-front costs, you should negotiate the origination fee downward and take the higher rate (if given the chance). It comes down to a question of paying the costs now or over the life of the loan.

But yes, mortgage origination fees can be negotiated during the loan process. If it turns out that your estimated closing costs are too high, you can ask the lender what you can do to reduce them. They may give you the option of taking a slightly higher rate in exchange for lower fees at closing. In this scenario, you are taking on more interest over the long term to reduce your up-front costs.

4. Can it be financed into the mortgage loan?

We've answered three important questions up to this point. What is a mortgage origination fee? How much do they cost? And are they negotiable? Here's another common question we receive: Can this fee be "rolled into" my loan and paid over time? In most cases, the answer is no.

Lenders charge origination fees in order to (A) cover their up-front costs and (B) make an up-front profit on the loan. They can't achieve either of these goals if they roll the fee into the loan. They may agree to reduce the fee in exchange for charging a higher interest rate, as mentioned above. But that's about it. Exceptions might be made for VA loans, as long as the total loan amount does not exceed VA limits for the county where you're buying.

5. Is the origination fee tax-deductible?

In most cases, you can deduct the amount you pay toward mortgage origination. But you must be buying a home as a primary residence, as opposed to a vacation home or investment property. I'll defer to the IRS on this question. Here's a relevant page from Publication 530 of the IRS tax code, which deals with mortgage-related tax deductions.

https://www.irs.gov/publications/p530

The flowchart below will help you determine which fees and points are tax-deductible, and which ones are not. Note: This is the 2013 version of the IRS flowchart. If you are reading this article after its publication date of July 2013, visit the link above to see if there's an updated version.

In general, you can deduct the mortgage origination fee if it was used for a home that is your primary residence. Or, as the IRS says: "Your loan is secured by your main home." There are some other stipulations as well, so you should read this section of the tax code for yourself.

6. When does the lender tell me the cost?

They might tell you what their mortgage origination fees are over the phone or face-to-face. But that doesn't make it official. The first time you'll see it in writing is when you receive your Good Faith Estimate form, or GFE for short.

By law, lenders are required to give borrowers a Good Faith Estimate shortly after the application is submitted. This generally happens within three business days of the application.

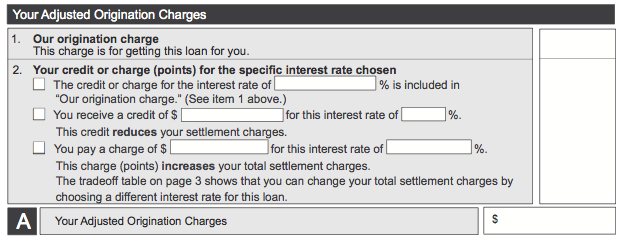

On page 2 of the GFE, the lender will indicate the mortgage origination fee you must pay at closing (see image below). They'll also indicate if your fee has been adjusted in some way, perhaps due to the negotiation process we described earlier.

Image: Page 2 of the GFE form where it discloses the origination charge

Important notes: This article answers several frequently asked questions, including: What is a mortgage origination fee, and how much is the average origination fee? Despite the length of this tutorial, there is still more to learn on this subject. This lesson is not meant to be exhaustive. It is only meant to give you a general understanding of how lenders use origination fees, and how it affects you as a borrower. We encourage you to continue your research beyond our website to learn all you can about this and other types of closing costs.