Reader question: “I will need help coming up with the down payment funds for my home loan (FHA program). What kind of down payment assistance is allowed for FHA home buyers in 2014? Are there any grants available for this sort of thing? Or do the funds have to come from a family member?”

The most common type of down payment assistance for FHA borrowers comes in the form of gifts from family members. HUD’s gifting rules for 2014 are the same as they were last year. This means borrowers can still use funds provided by a family member, or some other approved “donor,” as a form of down payment assistance on the loan. The money can also be put toward the borrower’s closing costs.

State and Local Assistance Programs

You might also be able to find some FHA down payment assistance programs in your city or state. A lot of these programs are local in nature, offered at the state level or below — as opposed to being federal / national in scope. So you have to research them at the local level.

Check out the HUD website for more information on this:

https://www.hud.gov/buying/localbuying

On the page above, you’ll find a list of local home buying programs that can be sorted by state. Some of these offer down payment assistance. Some offer “preferred rates” for eligible first-time buyers. Some offer counseling and guidance, and so on. They vary quite a bit. But it’s worth taking the time to see what is available in your area, in terms of home buying assistance.

The bad news is that there are fewer of these programs today, in 2014, as compared to previous years. Some of them faded away when the housing market tanked. But there are still options out there. You just have to turn over a few stones.

FHA Down Payment Gifts from Family Members

The Department of Housing and Urban Development (HUD) allows FHA down payment assistance in the form of a gift. As a borrower, you could have the funds gifted to you from a family member or a non-profit organization. HUD Handbook 4155.1, Chapter 5, Section ‘B’ covers the rules for FHA down payment gifts in 2014. Here’s a quick overview:

- You can use money gifted from family members to cover your down payment and closing costs.

- To be considered a gift, there must be no “expected or implied repayment of the funds.” In other words, it must truly be a gift — not a loan.

- The money can come from a family member, an employer, or a close friend with a “clearly defined and documented interest” in the borrower.

- Charities and government organizations that offer home-buyer assistance are also allowed to provide financial gifts to borrowers.

- The gift money cannot come from anyone involved in the sale (seller, agent, builder, etc.). See the next section for more on this.

FHA gift letters are still required in 2014. If you receive gifted funds from an acceptable source to cover your down payment, you must obtain a letter from the provider. The mortgage lender must include this document within the loan package. Fortunately, it’s a simple thing to create.

Read: Acceptable sources of down payment funds

Here are HUD’s requirements for FHA gift letters in 2014:

- The letter must include the name of the person providing the funds, along with their address, telephone number, the amount they are providing, and the nature of their relationship to you.

- The letter must clearly state that the donor does NOT expect any form of repayment or reimbursement. This is a key requirement for gift letters. They won’t be accepted otherwise.

Down Payment Assistance from Seller Not Allowed in 2014

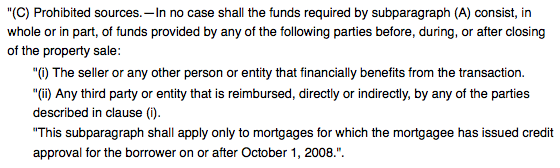

The FHA Modernization Act of 2008 prohibited down payment assistance from the seller involved in the transaction. You can look up the full text of this legislation online. If you refer to Section 2113 of the act, you will see that it prohibits down payment contributions from the seller. It also states that the borrower’s funds cannot come from any third party that requires reimbursement. But it does allow gifted funds from a family member, as long as they provide the gift letter we discussed earlier.

Here’s a snapshot of Section 2113, where it talks about prohibited sources of funds:

Sellers Can Contribute to Your Closing Costs

While the seller cannot make any contributions to your FHA down payment, they can make contributions to your closing costs. Under current HUD guidelines, the seller can contribute up to 6% of the purchase price to the home buyer’s closing costs. Just note the difference between “allowed” and “required.” Sellers are allowed to contribute to the buyer’s closing costs under this program — but they are not required to do it. So it’s up for negotiation.

Read: 5 most common reasons for FHA rejection

Disclaimer: This article offers an overview of the FHA down payment assistance rules for 2014. This information has been provided for educational purposes only and is not meant to take the place of one-on-one mortgage counseling. The Department of Housing and Urban Development (HUD) manages this loan program, and they make changes to the program on a regular basis. These changes can be found in the “Mortgagee Letters” section of the HUD website. For complete and current program guidelines, please refer to the official source: HUD Handbook 4155.1.

Brandon Cornett

Brandon Cornett is a veteran real estate market analyst, reporter, and creator of the Home Buying Institute. He has been covering the U.S. real estate market for more than 15 years. About the author