Home buyers tend to have a lot of questions about down payments. We know, because we receive quite a few emails on that subject.

One of the most common questions has to do with the timing of the down payment. Buyers often ask: When do I actually have to pay the down payment when using a mortgage loan?

When Do I Pay the Down Payment on a Home?

Let’s start with a short answer, and then go further into the details.

Home buyers usually pay the down payment on closing day. This is when the sale is finalized and all funds get distributed to the appropriate parties. You might also make an earnest money deposit, at the time you make an offer on a house. Later, that deposit becomes a credit toward your closing costs and down payment.

So, in a typical real estate transaction, the home buyer will make an earnest money or “good-faith” deposit up front when they submit an offer to the seller. That money is held in an escrow account until closing day, when it gets applied toward the purchase.

But the bulk of the down payment has to be paid on closing day.

Note: We’ve covered the earnest money deposit in a separate article. So you can follow the link to learn more about that, if you’d like. The rest of this article will focus on the down payment timing, and when it gets paid.

How It Ties Into the Home Buying Process

We’ve answered the main question here: When do home buyers have to pay the down payment when using a mortgage loan to buy a house? It usually happens on closing day, which is the final step in the process from the buyer’s perspective.

Now let’s zoom out and look at the home buying process as a whole. This will give you a better sense of the down payment timing, and when it occurs in relation to other important steps along the path.

While the home buying process can vary from one person to the next, it usually goes something like this:

- You get pre-approved for a mortgage loan to find out how much you can borrow.

- You start the house hunting process to find a suitable property that meets your needs.

- When you find a home you want to buy, you make an offer to the seller.

- Along with your offer, you might also make an earnest money deposit to show the sellers you are sincere in your desire to purchase their home.

- The seller accepts your offer and signs the purchase agreement / contract.

- You go back to your mortgage lender for final approval.

- Next comes the home appraisal and mortgage underwriting process.

- Once all of the details are finalized, you’ll attend closing and sign all of the required documents.

- You’ll also provide a cashier’s check (or wire transfer) to cover your closing costs and down payment — minus the earnest money deposit you already paid.

So, you might pay a small portion of the down payment in advance, in the form of an earnest money deposit. But the bulk of it gets paid on closing day.

The ‘Loan Estimate’ and ‘Closing Disclosure’

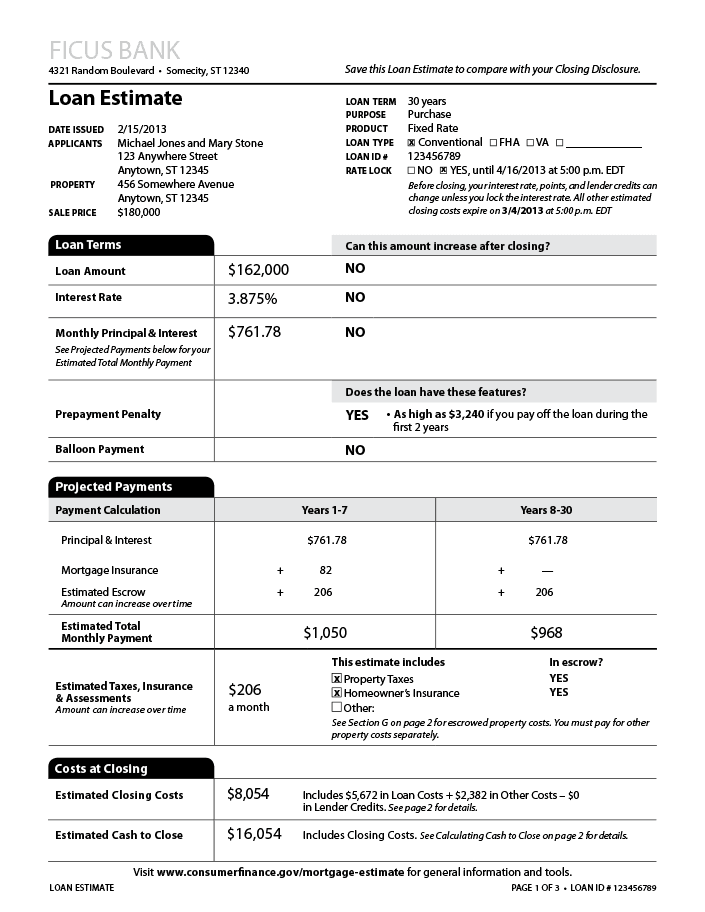

When you first apply for a home loan, you’ll receive a document known as a “Loan Estimate.” A few days before your scheduled closing date, you’ll receive a similar document known as a “Closing Disclosure.” (The second document is basically a finalized version of the first.)

Both of these documents show the amount of money you must bring to closing, in order to finalize the transaction.

The image below shows page one of the Loan Estimate. The Closing Disclosure document is nearly identical. At the bottom, you’ll notice two line items labeled “Estimated Closing Costs” and “Estimated Cash to Close.”

The “Estimated Cash to Close” line item includes the down payment along with the closing costs. And in the black shaded area, it tells you when you have to pay these expenses — “at closing.”

Related Down Payment Information for Buyers

Now you know when you have to pay the down payment on a home purchase, when using a mortgage loan. It gets paid on the day you close, with a credit from whatever amount you paid in earnest money. But there’s so much more to know about this subject.

For instance, did you know:

- These days, mortgage lenders allow borrowers to put down as little as 3% for a conventional or “regular” home loan.

- Borrowers who use the Federal Housing Administration (FHA) loan program to buy a house are required to put down 3.5% of the purchase price or appraised value.

- Borrowers who use the VA loan program can finance 100% of their purchase, in most cases.

- If you put down less than 20% on a home purchase (and therefore end up with a loan-to-value ratio above 80%), you’ll probably have to pay for mortgage insurance.

- Most of the mortgage programs available today allow home buyers to obtain their down-payment funds from a third party donor, such as a family member or close friend.

You can use the links provided above to learn more about these related topics. Or just click the “Advice” link in the main navigation menu above.

Brandon Cornett

Brandon Cornett is a veteran real estate market analyst, reporter, and creator of the Home Buying Institute. He has been covering the U.S. real estate market for more than 15 years. About the author