The Home Buyer's Guide to Online Mortgage Lenders

Read our most important home buying updates for 2024:

Reader question: "We want to apply for a home loan to see how much a house we can afford to buy. I've heard you can do a lot of this process via the Internet. But I'm not sure which lender to use, or how to start the process. Who are the best online mortgage lenders these days? Can I apply with several of them at once? And how should I get started?"

You've got quite a few questions rolled into one there. I'll tackle most of them in the course of this article. So bear with me. It's going to be a long lesson. Here's a "nutshell" version, you happen to be in a hurry:

In a nutshell: Any mortgage company that lets you submit an application through their website could be considered an online lender. But the process only starts online. You'll still have to mail or fax a variety of documents before you can get a final approval. The best lender is the one that gives you the lowest interest rate and the best terms. But the rate you receive will largely depend on your individual qualifications as a borrower.

Lender networks and lead-generation websites work differently. This is where you fill out a single application form to get quotes from several different mortgage companies. The goal here is to compare one loan offer to another, with minimal hassle. Always make sure you're on a secure website before providing any of your personal information.

We will discuss each of these things in detail below.

Fewer Online Lenders After the Housing Crisis

The first thing you need to realize is that there are fewer lenders today than in the past. This applies to mortgage companies in general, and to online lenders in particular. The housing crisis that erupted in 2008 sent a lot of banks into the financial graveyard.

The housing crash changed the mortgage industry in other ways, as well. You will face tougher lending criteria than a borrower from, say, 2003 or 2005. When you start working with online mortgage lenders, you'll quickly learn how the rules have changed. The qualification process takes longer today. You have to provide more documentation to prove your income, assets and debts. You'll need a higher credit score. All of these changes can be traced back to the mortgage meltdown of 2008.

But I digress. Let's return to the topic at hand, which is how to choose the best online mortgage company.

Is it a Mortgage Company, or a Lead Generator?

Before you start providing information about yourself online, you need to know who it is you're "talking" to. Just because a particular website offers you a quote for a home loan doesn't mean it's an online mortgage lender. It might just be a lead-generation website that passes your information along to other companies.

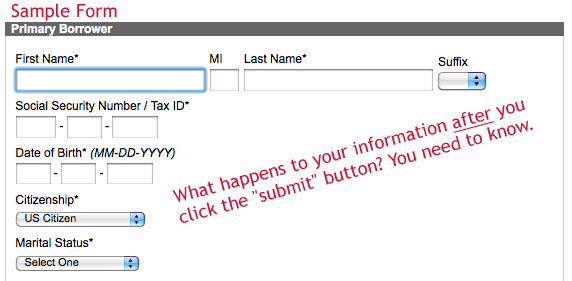

There's nothing wrong with that business model, per se. You just need to understand where your information is going after you click the "submit" button.

Online mortgage companies fall into several categories:

- Direct Lenders -- This is a bank or lender that actually funds the loan. They exist at the national, state and local level. Wells Fargo is an example of a national lender. California Bank and Trust is an example of a state lender. And then you have your banks and credit unions at the local level. Any of these lending institutions could function as an online mortgage lender, just by having a website with an application form on it.

- Mortgage Brokers -- A broker functions as a middleman between the borrower and the direct lender. Most brokers work with several different lenders, as opposed to just one. The advantage of using a broker is that it gives you access to more loan options and programs. Many brokers today have some kind of online mortgage application website, through which you can apply for a loan. They would then follow up with a phone call to learn more about your needs and qualifications. After that, the broker would try to match you up with the best lender.

- Lead Generators -- Also referred to as referral websites. These companies don't actually make loans. Instead, they specialize in generating leads from borrowers, and then passing those leads along to one of the direct lenders we talked about earlier. This is a viable way to gather mortgage quotes. You just need to understand how they use your information, for the sake of transparency. What happens to your name and contact information once you click the "submit" button? You need to find out before using one of these online services.

As you can see, the online lending environment is fairly diverse. Just because a website has an application form for you to fill out doesn't mean it's an online mortgage lender. It might be a broker's website. It might be a lender network or a lead-generation company. Or it might be the website of the actual bank who is going to lend you the money.

You need to know who you're dealing with before you give up your personal information. Read the fine print on the website. Navigate your way to the "about us" page, and find out exactly what the company does. And if you're still not sure, send them an e-mail to get your questions answered.

The Process Only Starts Online

There is a common misconception among homebuyers that the entire mortgage-application process can be handled online. This might be the case in the not-too-distant future. But right now, it doesn't work that way. In reality, the process only starts online.

The lender's website is simply a way for them to make the initial contact with a borrower. I'm not saying it's a waste of time to submit an online application form. On the contrary, it does give the mortgage company information they need to move things forward. But it's only the beginning of the process. There will still be plenty of phone calls, faxes and signatures, as you get further into the application and approval process.

With that being said, it is possible to complete most of the process without ever seeing your lender. Let me give you an example from my own personal experience:

The last time I applied for a home loan, I did it through the mortgage company's website. So, technically speaking, I was working with an online mortgage lender. I filled out the application form on the website, and a loan officer called me within a couple of hours. He gave me a list of the documents I would need to provide, in order to complete my application package. This included such things as tax returns, bank statements, and proof of income.

Next, my file was sent to their in-house processor, and then on to the underwriting department. I eventually received a final approval from the lender. They used a mobile notary service, so I was able to close the loan at a location that was convenient to me. I never even saw the loan officer face-to-face. It was all handled online, or through fax and e-mail.

This is how online mortgage lenders can save you time and energy. The process I described above wasn't even possible 10 years ago. Back then, you had to drive to the bank, sit down with the loan officer, fill out the paperwork, and then see what they were willing to offer you. If you wanted to shop around for the best deal, you had to repeat this process multiple times. But these days, you can apply for a loan through an online lender and skip several of those steps.

Before You Apply for a Home Loan

Earlier, we discussed how easy it is to apply for a mortgage loan online. Because of this, a lot of first-time home buyers rush into the process. They start talking to lenders before they have a budget in mind, or before they even know what kind of loan is right for them. This is a mistake. It can also lead to a lot of financial problems down the road. Just ask one of the millions of Americans who've been foreclosed on within the last two years.

Remember, the mortgage lender is not your financial advisor. They are in the business of selling money. They give you money to buy a house, and they charge interest on the loan to make money from it. That is the extent of your relationship with the lender. So before you start submitting loan applications online, you need to do a financial self-assessment.

Here are three places to start:

Question #1 - What is your credit score?

When you apply for a home loan online, the lender is going to check your credit score. This is probably one of the first things they will do after receiving your application. This three-digit number shows lenders how well (or how poorly) you have repaid your debts in the past.

Your credit score is one of the things that will determine whether or not you get approved for a loan. It also affects the interest rate you receive from the lender. This is why it's so important to check your credit before contacting any online mortgage companies [more information]. You need to find out where you stand before you try to negotiate the rates and terms.

Question #2 - How much can you afford?

If you've been skimming through this article up to this point, I want you to slow down and pay attention. I'm going to introduce a concept that could keep you out of hot water later on.

Mortgage affordability and approval are two different things. The lender will decide the approval factor. They will either approve you for a loan, or not. But you must determine the affordability factor for yourself.

Before you start dealing with online lenders or submitting loan applications, you should have a magic number in your head. This number is the maximum amount you can afford to spend toward a mortgage payment each month. You would come up with this number by comparing your net monthly income to your total monthly expenses. Here's how to go about.

Question #3 - Which type of loan is best for you?

This is something the lender might be able to help you with. But you should not rely entirely upon them to guide you. All too often, mortgage companies will steer borrowers toward the loan that works best for the lender -- not the borrower. Some new laws have been established in recent years, to prevent this kind of thing. But it still happens. That's why you need to research the different types of home loans and choose the one that works best for you.

The two biggest decisions you will make are as follows:

- Should I use a fixed or adjustable rate mortgage?

- Should I use a conventional or government-backed loan?

These aren't the only decisions you have to make when choosing a loan. But they are two of the biggest. Once you've answered these two questions, you're probably ready to move onto the next step -- getting pre-approved for a loan.

A Word About Internet Security

When using online mortgage lenders, you need to think about the security of your personal information. In some cases, these companies will ask you to submit sensitive information through their websites (such as your Social Security Number). So you want to make sure you're on a secure website.

Look for the 's' in the web address.

The web address where the submission form is located should start with https://. The 's' is the important letter. It means you're on a web page that has a minimal layer of security. Notice the difference:

- http://www.genericmortgagesite.com/apply (this page has no encryption security)

- https:// www.genericmortgagesite.com/apply (this page has some encryption security)

These two web addresses look identical. But the second one has the all-important 's' at the beginning, which means it has a basic layer of security. Learn more about https

Look for the third-party security seals.

You can also check the security of an online mortgage lender's website by using a third-party security seal. You can usually click the button to verify the company's security certificate. It gives you one more degree of confidence in the website you're using.