Estimating Your Closing Costs When Buying a House

Read our most important home buying updates for 2024:

A lot of first-time homebuyers are surprised by the amount of money they have to pay closing costs when buying a home. As a result, they have a hard time covering these costs. This is why it's so important to research this topic in advance, so you can save enough money.

In this article, we will talk about estimating your closing costs by using the Good Faith Estimate and other tools.

1. How to Get a Rough Idea

If you just want a ballpark figure, you can do a Google search for the average closing costs in your area. This will lead you to various articles and news stories about the subject.

It's important to research this topic by state, because the costs vary based on where you live. For example, New York is one of the most expensive states with closing costs averaging just under $6,000. Arkansas is one of the more affordable states with average closing costs of around $3,000. You can see how much of a difference it makes where you live. These numbers are for a $200,000 mortgage loan by the way.

The problem with this strategy is that most of the articles you find will downplay the total closing costs. For example, they might not mention the prepaid interest points you might encounter at closing, or the lender's fees (which can be several thousand dollars). To get a more complete estimate of your closing costs, you can use the other two strategies mentioned below.

2. Better Way to Estimate Closing Costs

A lot of banks and other financial websites have closing cost estimators you can use for free. These online calculators ask you for a variety of factors regarding your loan (city and state, loan amount, down payment, etc.). Then they give you an estimate of what your closing costs might be. As you can see, it's more accurate and specific than strategy #1 above.

You can find literally hundreds of closing cost estimators online these days. But some are better then others. The best calculators will ask for the city and state where you want to buy. This information is needed to provide a more accurate estimate. Remember, we talked about how much closing costs can vary, based on your city and state. The good ones will also ask you for the amount of the loan, the size of your down payment, and other information.

Two of my favorite closing costs estimators are the ones offered by Bank of America and Zillow. You can find either of these with a quick Google search. Example: just type "Bank of America closing cost estimator" into a search engine, and you'll find it. They move their calculators around, so I don't want to put a hyperlink on this page that's just going to end up broken. Google them and you'll find the right page.

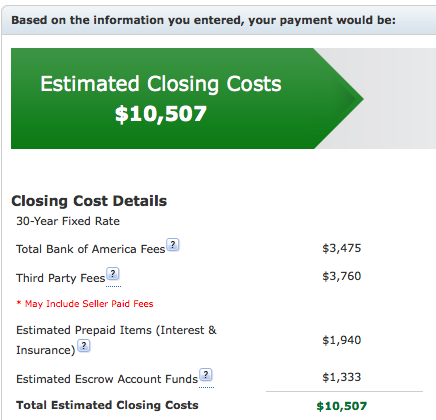

Here's a screenshot of Bank of America's estimator. I put it in details for a $500,000 mortgage loan in the Carlsbad, California area. I selected 10% as my down payment for a 30-year fixed mortgage. The calculator pre-populated some other fields for me, using average numbers (mortgage origination fees, etc.). Based on that information, it presented me with the screen below.

You can see that this tool estimates my closing costs to be around $10,507 dollars. When I entered these same parameters into Zillow's closing cost estimator, I was presented with an estimate of around $12,500. If you use these two calculators and take the average of the numbers they give you, you'll have a decent estimate of closing costs -- as accurate as possible without an actual loan application.

The two strategies above are for estimating closing costs without dealing with a mortgage lender. But if you're actually ready to move forward with the process, you can get an estimate on paper from the lender. So let's talk about that document next...

3. Estimating Costs With the Good Faith Estimates (GFE)

Estimating your closing costs even more accurately can be done through the Good Faith Estimate, or GFE. This is a document that mortgage lenders are required to give you shortly after you apply for a loan. Federal lending laws mandate that lenders must produce this document within three days of your application.

Actually, they must give you a GFE anytime you provide the following information:

- Your full name

- Social Security number

- Monthly income

- Property address

- Property value or sales price

- Loan amount

In the past, it was common to have a large discrepancy between the amount of closing costs estimated on the GFE and the actual amount paid at closing. In fact, the GFE was something of a joke in the lending industry. Everyone knew the borrower would end up paying more on closing day then the lender estimated at the time of application. But that has changed to a certain degree.

The New GFE Form

In 2010, the Department of Housing and Urban Development (HUD) made some changes to the faith estimate. For one thing, lenders must now use a standardized form to estimate closing costs and other mortgage components. Click the image to the left to see the new form up close.

Lenders also face a financial penalty if the actual closing costs differ from the estimated costs by more than ten percent. In other words, if they lowball the GFE and then charge you a lot more money on closing day, they have to cover anything that exceeds a ten-percent difference.

Aside from estimating your closing costs, the GFE gives you some other useful information. It may also tell you what your initial interest rate will be, and whether or not the interest rate can rise.

It also shows you how much your mortgage payments will be. And if your loan comes with any prepayment penalties, the GFE will let you know about those as well.

Expect Surprises and Plan Early

As a home buyer, the best thing you can do to prepare for your closing costs is to start saving money as early as possible. The GFE is helpful for estimating your total costs, but it's rarely 100% accurate. So it's always a good idea to save more money than you expect to spend on the mortgage loan.

Remember, your closing costs are above and beyond your down payment. They are two separate things. So you will need to save enough money for those two items at a bare minimum.

Your mortgage lender might also require you to have additional cash reserves in the bank, above and beyond your closing costs. They do this to make sure you can cover your first couple of mortgage payments. Some lenders will turn around and sell your loan into the secondary mortgage market through Fannie Mae or Freddie Mac. So they want to make sure you've got the funds to cover the first payments while they still have the loan on their books. This is why they often require additional cash reserves.

Estimating closing costs can be a helpful and insightful part of the home-buying process. There are several ways to estimate your costs, and some are more accurate than others. You can do a Google search to find average costs in your area. You can use a calculator to estimate your closing expenses. And you can apply for a loan to get a Good Faith Estimate (GFE) from a mortgage lender.

If you would like to learn more about this topic, you can use the search tool located at the top of this page. You can also visit the real estate closing section of our website for related articles.ttt